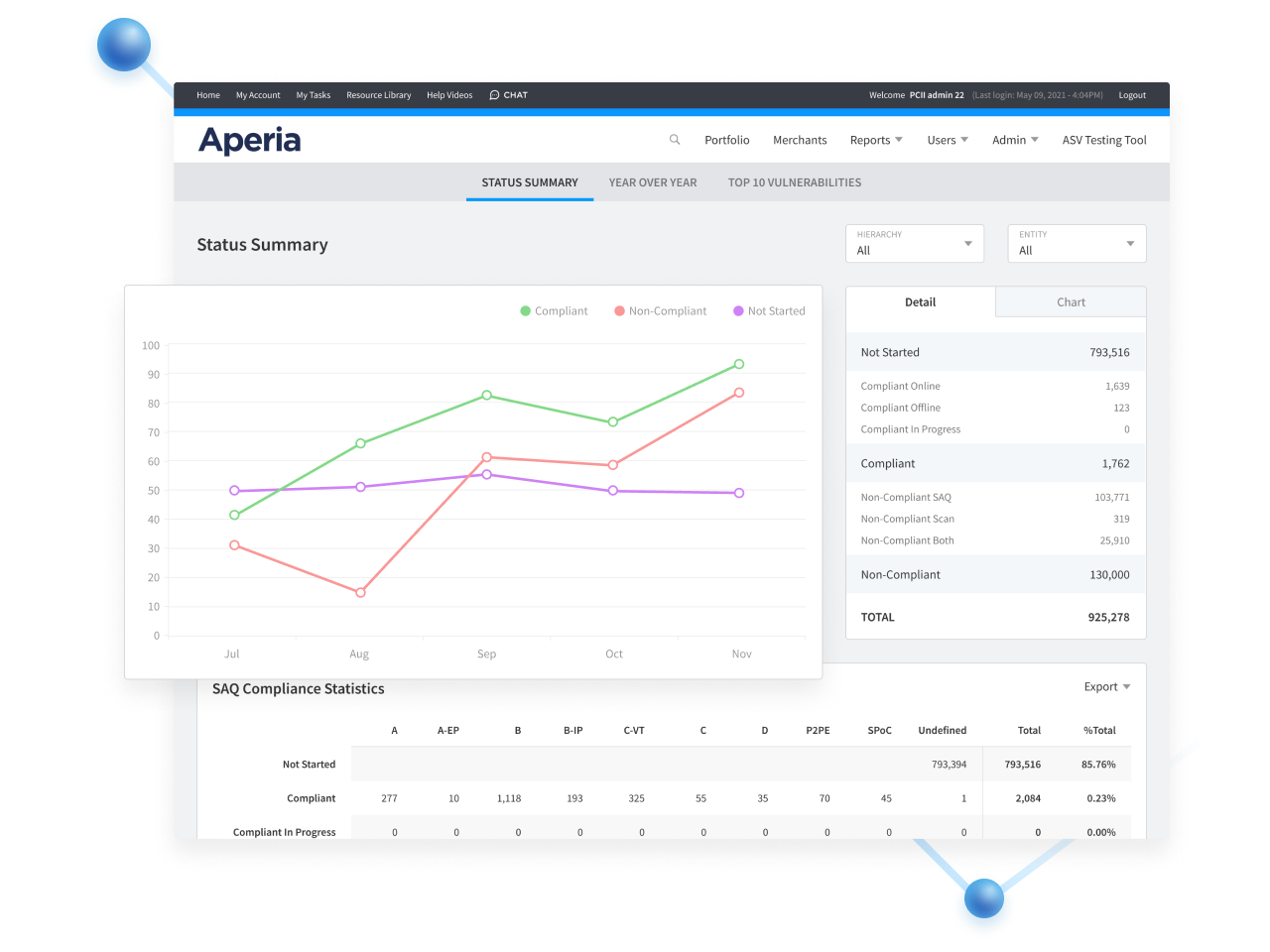

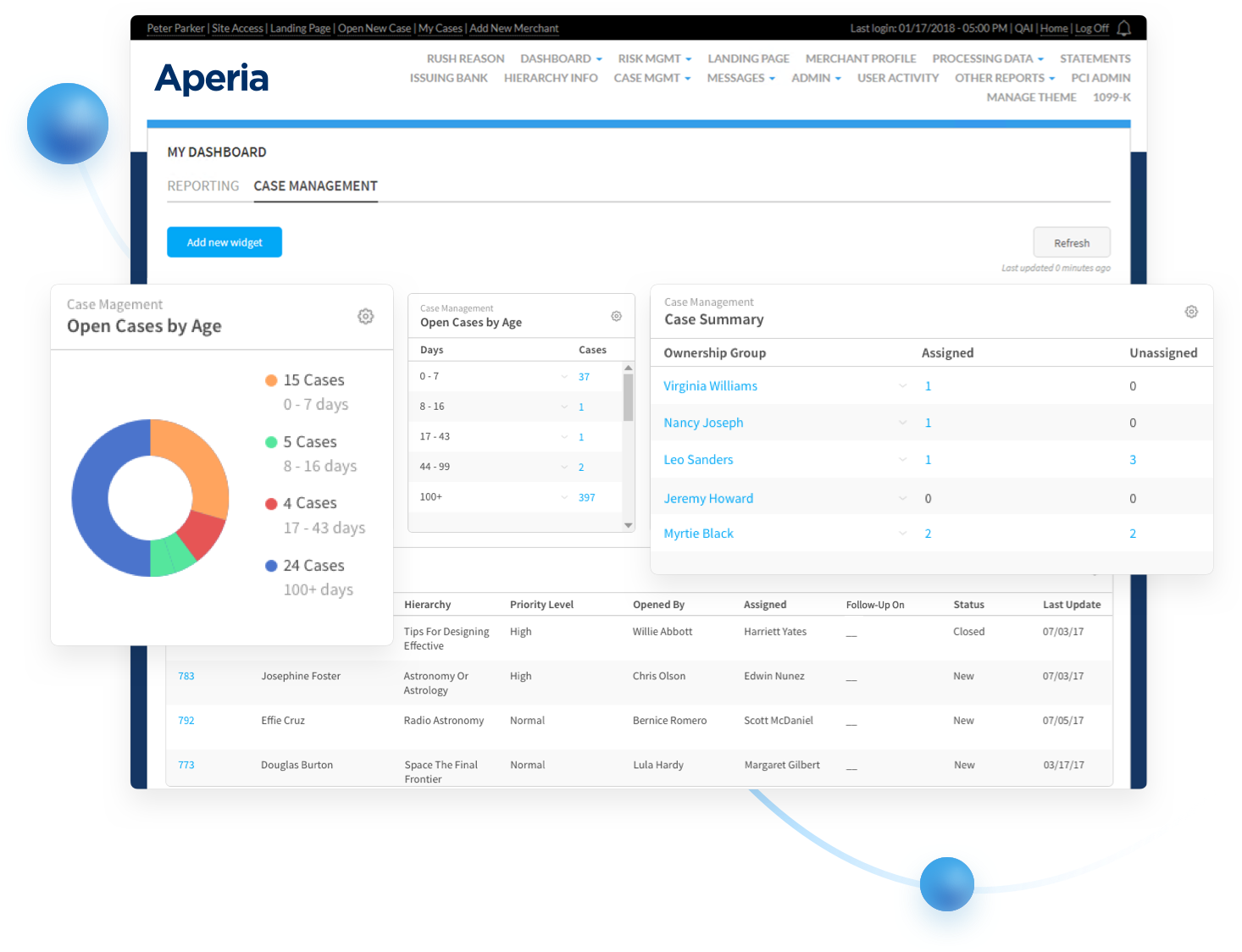

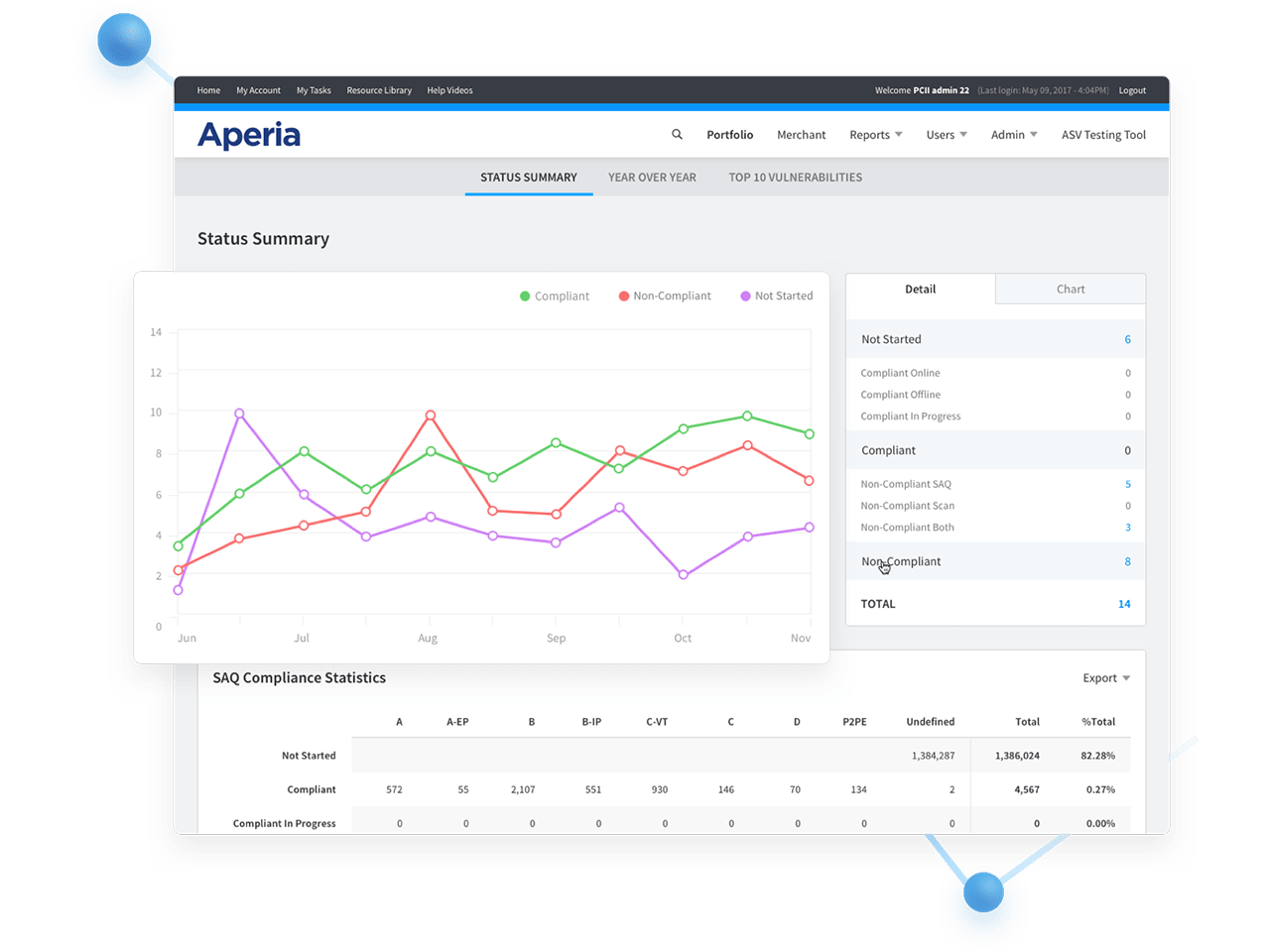

Our platform supports multiple hierarchies that your staff can manage or separate according to their risk profile or book of business. The system, which contains a reporting engine, provides the ability to produce custom management reports and various standard reports, including Visa, MasterCard, and Discover reports, so that your staff can spend less time preparing reporting and more time servicing your customers.

Breach Protection

Merchants who suffer a data breach can face fines from the card companies and state and federal regulatory authorities, which is why Aperia has developed a holistic data protection program. Our program provides access to legal assistance for the merchant, lines up investigatory resources, covers the cost of remediation in lieu of fines, and provides financial protection to ensure that merchants and their payment providers are protected from loss.

Data Discovery

Running a data discovery tool is mandatory under HIPAA and the PCI DSS. Aperia provides a robust data discovery tool that provides merchants visibility into where sensitive data is residing unprotected on their network, which is the first step to eradicating it and reducing the threat of a data breach.

In addition to risk reduction, this tool also assists merchants with meeting their contractual and regulatory compliance requirements.

Anti-Keylogging

Over the years, one of the hacker’s most effective methods has been installing malware that performs keylogging on merchant networks. Keylogging allows hackers to steal cardholder data, including merchants’ and users’ credentials, thereby allowing them unfettered access to the merchant’s network and financial accounts. Aperia’s anti-keylogging solution protects by encrypting the user keystroke activity on all endpoints, including BYOD configurations, thereby closing off this attack vector for the merchant.

Business Restitution

Aperia understands that small businesses are sometimes ill-equipped to wade through the red tape and legal maneuvering required to restore their good name and to recover damages caused by a business identity theft. That is why we have partnered with Experian to provide a white-glove service for merchants who take on the heavy lifting involved in this credit restoration process and provide up to $1 million in protection for losses related to:

- Attorney and legal fees.

- Lost wages or income.

- Unauthorized electronic fund transfer.

- Child and elderly care that would otherwise not be incurred resulting from time spent amending records related to

ID theft. - Costs for refiling loan applications, credit reports, ordering medical records, replacement of identification cards (driver’s license and passport), investigative agency, notarization services, and losses due to theft.

Endpoint Protection

Predict – Prevent – Protect.

Aperia has partnered with CylancePROTECT®, the only enterprise endpoint solution that blocks threats in real time before they ever cause harm.

Our solution provides end users with the most accurate, efficient, and effective method for preventing advanced, persistent threats and malware from executing on their endpoints. It is especially effective in preventing Ransomware, blocking 0-day (previously unknown) attacks, and preventing phishing attacks.

At the core of our endpoint protection is a revolutionary machine-learning research platform that harnesses the power of algorithmic science and artificial intelligence, and provides unprecedented malware identification capability. It analyzes and classifies hundreds of thousands of characteristics per file, breaking them down to an atomic level to discern whether an object is good or bad in real time.